Temporary Sales Tax Increase

Multi-Generational Community Center and Aquatic Center

Funding Source

Follow the Project!

Council Adopts Sales Tax Increase

On October 19, 2021, Town Council passed Ordinance No. 2021.022 relating to Transaction Privilege Tax, amending the Town tax code by increasing the tax rate on certain activities by one-half cent for the design and construction, and fixtures, furniture and equipment, for a new multi-generational community center and aquatic center. Read the ordinance(PDF, 196KB).

View the October 19 Town Council meeting.

Public Notice

Posted August 18, 2021

In accordance with A.R.S Section 9-499.15, PUBLIC NOTICE IS HEREBY GIVEN, that the Marana Town Council may consider approving a ½% tax rate increase to the following transaction privilege tax classifications for the purpose of funding certain infrastructure and municipal building projects, such as the Multi-generational Community Center and Aquatic Center at a public meeting at 11555 W. Civic Center Drive, Marana, Arizona 85653 at or after 6:00 P.M local time on Tuesday, October 19, 2021.

Read the full public notice posting(PDF, 48KB).

Read a schedule of the proposed increased tax(PDF, 138KB)

that includes the amount of the tax and data supporting the new increase.

Scroll down to learn more about the Town of Marana multi-generational recreation facility and aquatics center.

Parks & Recreation Master Plan

Parks & Recreation Master Plan 2020-2030(PDF, 20MB)

Parks & Recreation Master Plan 2020-2030(PDF, 20MB)

As part of the Parks & Recreation Master Plan 2020-2030, the Marana community expressed a need for a multi-generational community center and aquatic facility.

Learn more about the Town of Marana’s solution for bringing this vision to life below.

Videos

July 15, 2021 Sales Tax for Recreation Facility Presentation

(Download the PowerPoint presentation(PDF, 6MB))

Project and Sales Tax Information Video

In the Media

Recreation is the Heart of Marana

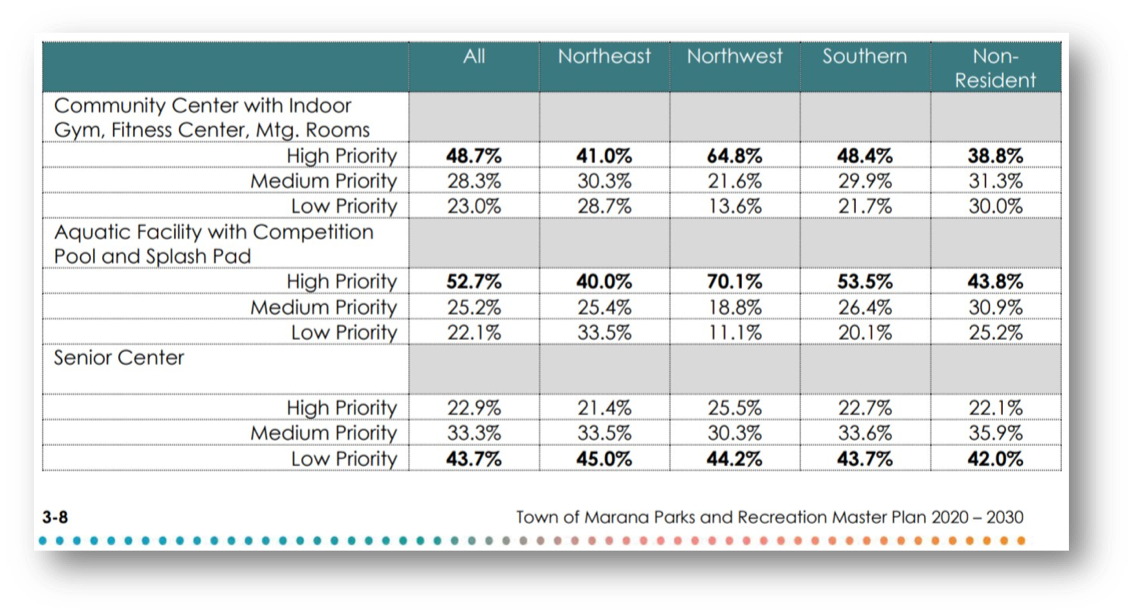

Priority needs as identified by the Town of Marana Parks and Recreation Master Plan 2020-2030.

According to the Town of Marana Parks and Recreation Master Plan 2020-2030, interest in a multi-generational community center and an aquatics facility were expressed throughout the community as a high priority.

- High-priority resident interest in a multi-generational community center with an indoor gym, fitness center, and meeting rooms ranged from 41% to 64%

- High-priority resident interest in an aquatic facility with competition pool and splash bad ranged from 40% to 70.1%

Telephone Surveys

86% of respondents supported a MultiGen community center

82% of respondents supported a year-round aquatics facility

Online Surveys

84% supported a MultiGen community center

78% supported a year-round aquatics facility.

Who Will This Multi-Generational Recreation Center & Aquatics Facility Benefit?

The facilities would serve the needs and preferences of all members of the community including children, teens, young adults, adults, seniors, and the special needs population. The facilities are projected to have an indoor gymnasium, weight training areas, cardio fitness space, group exercise rooms, meeting rooms, and other related facilities.

Why a Sales Tax?

Population Growth

Marana is a rapidly growing community. Current revenues must be used to meet the growing service expectations.

A dedicated half-cent sales tax would be used exclusively for the creation of a multi-generational community center and aquatics facility.

*2020 population on the graph is an estimate from the AZ Commerce Authority until Census 2020 data is released in Fall 2021.

Current Sales Tax Regional Rate Comparison

- Sahuarita: 2.0%

- Oro Valley: 2.5%

- Tucson: 2.6%

- South Tucson: 5.0%

- Marana: 2.0%

FAQ

What is the Proposed Sales Tax Increase for?

The proposed sales tax increase will be dedicated to the construction of a multi-generational recreation center and aquatics facility.

How Much of an Increase Are You Proposing?

A half-cent sales tax increase is proposed to fund both the multi-generational community center and aquatic facility. This would raise approximately $6 million a year and would fund a $40 million dollar project over seven years.

What Happens After Seven Years When the Facilities Are Paid Off?

Marana Town Council has chosen to sunset the tax after funding for the project is completed.

What is Affected by a Sales Tax Increase?

Sales tax is generated from retail purchases. It does not apply to non-prepared (grocery store) food items.

Who Pays This Sales Tax?

Research has shown that a large portion (at least half or more) of the sales tax we collect in Marana, comes from people outside of our community. Whether they are tourists, visitors, or southern Arizona residents from outside of the Town boundaries, the ability to pay for a significant portion of the facility through tourism and non-resident dollars could be, and likely will be, viewed by some as a great benefit to the community.

How Does the Town of Marana's Sales Tax Compare to Neighboring Jurisdictions?

The Town of Marana's current sales tax rate is 2%, whereas Oro Valley and the City of Tucson are 2.5% and 2.6% respectively. This suggested increase of a half-cent brings us even with the adjoining municipalities.

Doesn't the Town of Marana Collect Enough Taxes? What About Property Taxes?

Contrary to what many people think, Marana does not levy a property tax. The tax that residents currently pay on their property goes to entities such as Pima County, school districts, special taxing districts and fire districts.

Has the Town of Marana Increased Taxes Before?

The Town of Marana has had success in the past using temporary half-cent sales tax increases to pay for special projects, such as a portion of the Twin Peaks Overpass and Twin Peaks Road and the Marana Police Facility. The decision of permanent or temporary will be made by Town Council in the fall.

Will There be a Fee to Use the Facilities?

Community recreation centers vary in their approach with regard to recovery costs. Some try to recover as much as 60-70%, some only charge to recover 20-25% of the operational costs. Town Council will approve a fee schedule within six months prior to opening the facilities, with the goal of recovering a portion of operational costs. Senior fees, family memberships, non-resident fees, rentals, and more will be considered at that time.

Please note that the proposed sales tax increase is intended for the construction of the facilities, and will not be used to recover operating costs.

Project Sneak Peak

The Town of Marana would like to construct a 55,000 square foot multi-generational community center and aquatic center, with an indoor gymnasium, weight training areas, cardio fitness space, group exercise rooms, meeting rooms, and other related facilities. The project will be located on the corner of Marana Main Street and Bill Gaudette Drive in north Marana.

Several locations for the multi-generational recreation center and aquatics facility were considered by Marana Town Council as part of a comprehensive site study. This chosen site was considered the best fit due to the anticipated growth north along Interstate-10, eventually becoming a central hub for the community.

These photos are conceptual and do not represent the final project.

Public Meeting Schedule

Attend a public meeting to learn more about the proposed sales tax increase from Town staff. If you are unable to attend, the meetings will be recorded and posted online for viewing.